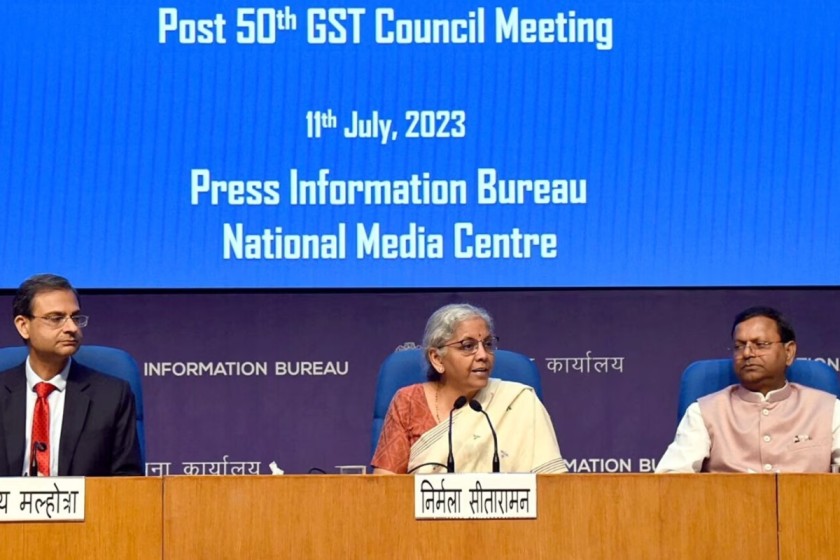

- July 13, 2023

GST Council meeting yields mixed results

The GST Council has made significant decisions, including tax clarity on online games and casinos, and rate rationalizations.

The Goods and Services Tax (GST) Council has taken over 1,500 decisions in its fifty meetings in an effort to make the tax system robust. These include clarity on the taxability of online games and casinos, the establishment of the GST Appellate Tribunal, guidelines to tackle fake registrations and rate rationalisations at the meeting held on July 11.

Tax Hurdles for online games

The taxability of online games is a contentious issue in the GST regime. There has been a lack of clarity on the rate applicable to such games and the value on which the GST would be applicable. The industry had been of the view that games of skills should be taxed at 18 percent while games of chance should be taxed at 28 percent. It was also felt that the GST should be levied on the value of net winnings. The GST Council however decided that GST at 28 percent shall be levied on all forms of online games, casinos, horse racing, etc. The longstanding distinction between games of skill and games of chance, which had recently been upheld by the Karnataka High Court, has been done away with. The effect of this decision is that games of skill and games of chance both will be treated on par. The Council has also decided that the 28 percent GST shall be applicable on the entire face value (gross amount) and not the net value. The tax will come into effect once necessary amendments are made to the GST laws in due course. It is fair to assume that these recommendations shall have a prospective effect. The question that then needs to be addressed is whether 18 percent on games of skill and 28 percent on games of chance, both on net value, shall be applicable to past transactions.

The entertainment industry had a long pending demand that GST on food & beverages served in cinema halls be reduced from the current 18 percent to five percent (similar to restaurant services). The decision of the Council to accept this demand is a step in the right direction, as it will make the movie-going experience pocket-friendlier and provide a boost to the entertainment industry. For the impact of the expansion in the scope of taxation for SUVs, one would need to look at the fine print.

The clarification from the Council that the input services distributor (ISD) mechanism is not mandatory for the distribution of input tax credit (ITC) of common input services procured from third parties provided much-needed relief. It has settled the confusion on whether such ITC has to be distributed through ISD or cross-charge. Suitable amendments to GST law recommended by the Council to make ISD mandatory puts to rest pending investigations and litigations.

In other decisions, the clarification on the applicability of reverse charge mechanism (RCM) on the supply of services made by a director of a company to the body corporate will assist companies to identify their GST liability accurately. It was clarified that GST shall be paid by the body corporate under RCM if such services are provided by a person in the capacity of a director. Rates on a few goods and services were lowered, but a greater rate rationalisation is required to be initiated and discussed with relevant stakeholders including trade & industry.

Over the past few months, the government has been on a mission to fix leakages of GST through massive investigation drives. Fake registrations and fraudulent ITC claims running into thousands of crores of rupees have been detected. More measures to catch fake registrations were announced. Measures announced such as physical verification of the business premises of an applicant without the actual presence of the applicant and a system-based suspension of registration proposed to be introduced for those who do not provide details of a valid bank account will help in curbing tax evasion. Having said that, the authorities may need to be mindful that such measures do not become intrusive or hinder the business of honest taxpayers.

The non-existence of the GST Appellate Tribunal has clogged high courts of various states as taxpayers have no alternate remedy. The decision to begin the process of establishing the tribunal from August 1, was long-awaited and the sooner the Tribunal is up, the better it is for dispute resolution.

The latest GST Council meeting was eventful as it clarified many long pending issues and accepted specified demands of the industry. The devil lies in the detail and hence careful examination of the amendments, notifications and circulars will be required to fully assess the impact of various announcements.

Pratik Jain is Partner and Anita Rastogi is Principal at Price Waterhouse & Co LLP.

Views are personal and do not represent the stand of this publication.