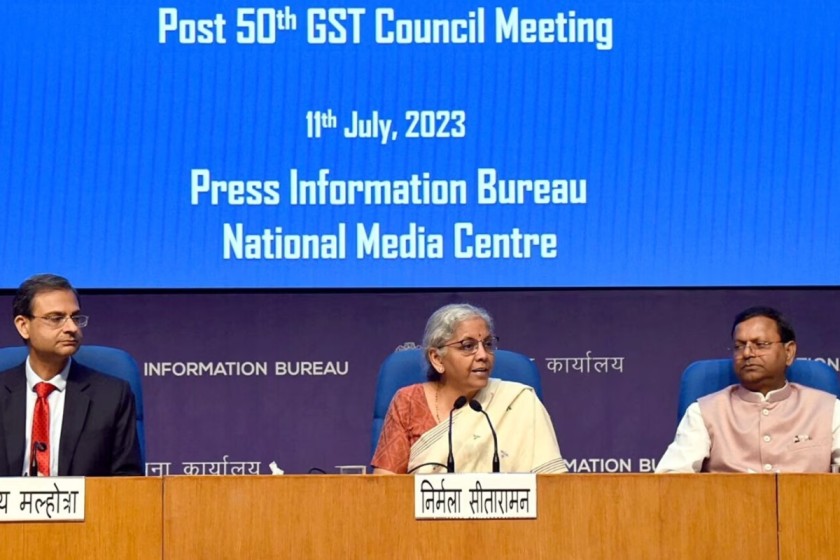

Resilient Indian Economy: FinMin report highlights robust domestic dynamics

India’s Finance Ministry acknowledges strong domestic economic dynamics while cautioning against global factors that could hinder high growth. In its

Read More